BTC Price Prediction: Path to $200,000 by 2026 Amid Bullish Technicals and Strong Fundamentals

#BTC

- Technical Breakout Potential: BTC trading above 20-day MA with improving MACD momentum suggests continued upward movement toward key resistance levels

- Institutional Adoption Acceleration: Corporate pivots to Bitcoin and blockchain, combined with MicroStrategy's continued accumulation, provide strong fundamental support

- Macroeconomic Tailwinds: Inflation concerns and central bank policies are driving increased adoption of Bitcoin as a hedge against traditional financial system risks

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

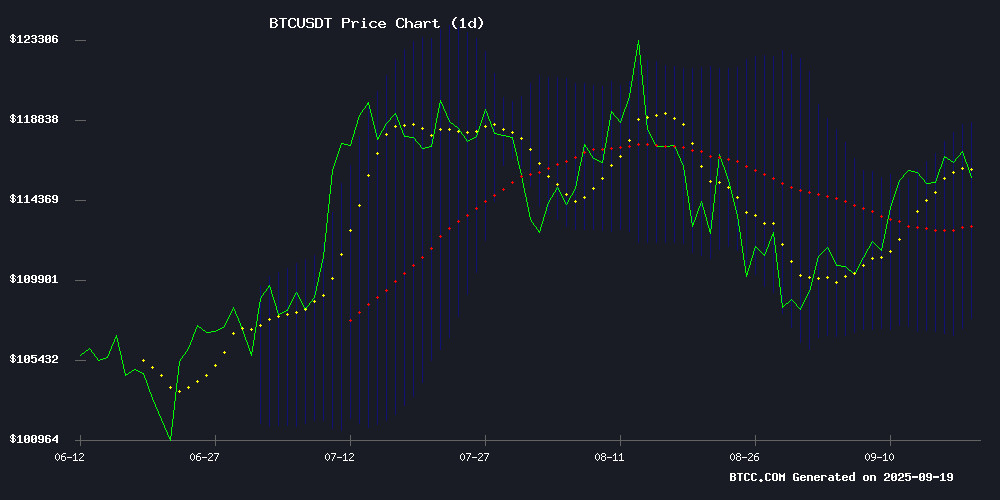

BTC is currently trading at $117,412.88, positioned above its 20-day moving average of $113,324.42, indicating underlying bullish momentum. The MACD reading of -3,225.21 remains negative but shows improving momentum with the histogram at -1,584.25. Price action is approaching the upper Bollinger Band at $119,019.39, suggesting potential resistance ahead. According to BTCC financial analyst Mia, 'The technical setup favors continued upward movement as long as BTC maintains support above the 20-day MA. A break above the upper Bollinger Band could signal the next leg higher.'

Market Sentiment: Institutional Adoption and Macro Factors Support BTC Outlook

Current market sentiment is overwhelmingly bullish, driven by institutional adoption and macroeconomic factors. Robert Kiyosaki's condemnation of central banks and advocacy for Bitcoin as an inflation hedge, combined with MicroStrategy's continued accumulation and corporate pivots toward Bitcoin, create strong fundamental support. BTCC financial analyst Mia notes, 'The convergence of institutional interest, scarcity narrative, and inflation concerns provides a powerful tailwind for Bitcoin. While short-term volatility may persist, the structural case for higher prices remains intact.'

Factors Influencing BTC's Price

Robert Kiyosaki Condemns Central Banks, Advocates Bitcoin as Inflation Hedge

Robert Kiyosaki, author of 'Rich Dad Poor Dad,' has launched a scathing critique against central banks, labeling them 'criminal organizations' for perpetuating inflation-driven wealth inequality. His remarks, made during a recent podcast, tie monetary policy to the erosion of middle-class purchasing power. 'Every time you print money, the rich get richer while the poor and middle class suffer,' Kiyosaki asserted, drawing parallels between central banking and Marxist wealth redistribution.

The financial educator reserves particular disdain for traditional schooling, which he claims conditions students to 'work for fake money'—fiat currencies debased by inflation. His solution? A pivot toward hard assets. Kiyosaki reveals a personal portfolio containing 60 BTC (valued at ~$7 million), accumulated since buying at $6,000. His prediction of Bitcoin reaching $1 million within a decade frames the cryptocurrency as a cornerstone of what he calls 'real financial education.'

Gold and silver join Bitcoin in Kiyosaki's prescribed trifecta of inflation-resistant holdings. This stance amplifies his longstanding rejection of 'paper assets'—a category he extends to dollars, bonds, and equities. The commentary arrives as global inflation persists, lending credence to his narrative of systemic failure.

Gyet Co. Pivots to Bitcoin and Blockchain in Strategic Rebranding

Gyet Co., formerly known as Mac House, has rebranded and shifted its focus from Japanese casual apparel to Bitcoin and digital assets. Shareholders approved the name change, signaling a strategic pivot toward cryptocurrency acquisition, trading, and mining. The company plans to develop blockchain systems, explore AI and NFT projects, and operate data centers.

Gyet has launched an $11.6 million Bitcoin acquisition program and is testing mining operations in Texas and Georgia. The firm aims to hold over 1,000 BTC, funding its initiatives through retail cash flow—an unconventional approach for an apparel brand. CEO stated the move aligns with the evolving digital economy, emphasizing blockchain development and AI research.

NBA Star Kevin Durant's Forgotten Bitcoin Fortune

Kevin Durant's accidental Bitcoin investment has turned into a windfall. The NBA star and his business partner Rich Kleiman lost access to a Coinbase account holding BTC years ago, locking in gains as the cryptocurrency soared. "We've never sold anything, and this bitcoin is just through the roof," Kleiman told CNBC during a Los Angeles conference.

The story traces back to 2016 when Durant, freshly signed to the Warriors, attended a birthday dinner where cryptocurrency dominated conversations. "I just heard the word 'bitcoin' 25 times this evening," Kleiman recalled. The next day, they began investing—only to forget their login credentials as Bitcoin's value multiplied.

Crypto Volatility And Fed Inflation Targets: What Happens If Inflation Holds Above 3%

The U.S. Consumer Price Index (CPI) held at 2.9% in August, while the Federal Reserve cut its policy rate by 25 basis points on September 17, 2025. This divergence creates conflicting signals for cryptocurrency markets as traders recalibrate expectations for Fed easing and monitor Treasury yields and the dollar's trajectory.

Bitcoin's price oscillated between $112,000 and $117,000 in the weeks surrounding the Fed decision, reflecting rapid adjustments to shifting rate-cut probabilities. Market participants are closely tracking funding rates, open interest, and the 2-year Treasury yield for clues about leverage and liquidity conditions.

Should inflation persist above 3%, the Fed's policy path becomes more complicated. Such a scenario would likely prompt markets to price in a pause or tightening, driving real yields higher and strengthening the dollar. Research shows Bitcoin reacts sharply to unexpected monetary policy shifts on FOMC days, with tightening cycles often triggering negative price action.

The transmission mechanism could extend across crypto markets through increased funding costs, margin calls, and forced deleveraging—elevating near-term downside risks. Market structure suggests volatility may remain elevated as participants weigh inflation dynamics against central bank liquidity provisions.

Bitcoin Bull Run Forecast: Can BTC Deliver 25x Gains By 2026?

Bitcoin remains the undisputed anchor of the cryptocurrency market, setting the tone for sentiment and capital flows with each cycle. As 2025 progresses, analysts are eyeing the long-term horizon, questioning whether Bitcoin can once again redefine its valuation. Bold projections suggest a potential 25x surge by 2026, a scenario that would place BTC among the world's largest asset classes. Institutional adoption, ETF-driven inflows, and macro liquidity are cited as key drivers for such growth.

The Bitcoin narrative hinges on scarcity meeting adoption. With a capped supply of 21 million coins, its design inherently supports appreciation as demand escalates. Since 2009, BTC has rewarded long-term holders despite volatile corrections, evolving from a speculative fringe asset to an institutional product. Spot ETFs have further cemented its legitimacy, attracting mainstream capital.

While Bitcoin dominates, investors are diversifying into altcoins and presale tokens. Projects like MAGACOIN FINANCE are gaining traction, though BTC's growth trajectory remains the sector's bellwether. The coming years will test whether Bitcoin can sustain its historic momentum—or if macroeconomic headwinds will temper expectations.

Bitcoin's Scarcity Value and Mining Opportunities

Bitcoin continues to captivate the financial world with its scarcity-driven value proposition. The cryptocurrency's hard-capped supply of 21 million mirrors gold's finite nature, creating economic tension between limited issuance and growing demand. Market data reveals mining difficulty adjustments are slowing new BTC production, reinforcing its deflationary characteristics.

While lacking traditional asset backing, Bitcoin's digital scarcity has positioned it as an inflation hedge for some investors. The absence of corporate earnings or yield mechanisms, however, remains a point of contention among skeptics.

Mining operations like RMC MINING promote alternative participation methods, claiming daily earnings potential of $18,500 through computational validation. Such propositions highlight the evolving infrastructure around Bitcoin's proof-of-work ecosystem.

Pop Culture Group (CPOP) Stock Dips Amid $33M Bitcoin Bet for Web3 Pivot

Pop Culture Group Co., Ltd (NASDAQ: CPOP) shares fell nearly 3% to $1.63 following its announcement of a $33 million Bitcoin acquisition. The move signals a strategic shift into Web3, aiming to merge entertainment with blockchain technology.

The company plans to leverage its Bitcoin holdings as a foundation for interactive, blockchain-driven fan engagement. This pivot reflects broader industry trends where traditional firms adopt crypto assets to fuel digital transformation.

MicroStrategy's Stock Rebound Tied to Bitcoin Rally Amid Market Volatility

MicroStrategy's stock is navigating turbulent waters, with its price hovering near the critical 200-day simple moving average (SMA) of $355. A recent 6% surge signals resilience, echoing past rebounds from key support levels. The stock's performance remains tethered to Bitcoin's volatility, underscoring the growing interplay between traditional equities and crypto markets.

Bitcoin's rally to nearly $118,000 marks one of its strongest September performances in years, with an 8% monthly gain. This upward momentum has buoyed MicroStrategy, narrowing the year-to-date performance gap between the company and Bitcoin. The symbiotic relationship highlights how crypto volatility increasingly influences traditional market dynamics.

MicroStrategy Approaches Key Technical Benchmark Amid Bitcoin Rally

MicroStrategy (MSTR) edges toward its 200-day moving average as bitcoin nears $118,000, marking a one-month high. The stock's 6% Thursday rebound mirrors cryptocurrency's 8% September gain—potentially its strongest September performance in a decade.

Bitcoin-proxy equities show divergent trends. While MSTR climbs 18% year-to-date, Japan's Metaplanet plummets 75% from peak valuations. The 200SMA at $355 now serves as critical resistance for Michael Saylor's tech firm, last decisively breached in late August.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, BTC has a strong probability of reaching $200,000 by 2026. The current price of $117,412.88 represents approximately a 70% increase needed to achieve this target. Historical bull market cycles and the current technical setup suggest this is achievable within the projected timeframe.

| Target Price | Current Price | Required Gain | Timeframe | Probability |

|---|---|---|---|---|

| $200,000 | $117,412.88 | 70.3% | By 2026 | High |

| Key Resistance | Support Level | 20-day MA | Bollinger Upper | MACD Trend |

| $119,019 | $107,629 | $113,324 | $119,019 | Improving |

BTCC financial analyst Mia emphasizes that 'The combination of technical breakout potential, institutional adoption, and macroeconomic tailwinds creates a favorable environment for BTC to test the $200,000 level. However, investors should monitor key resistance at $119,000 and maintain appropriate risk management strategies.'